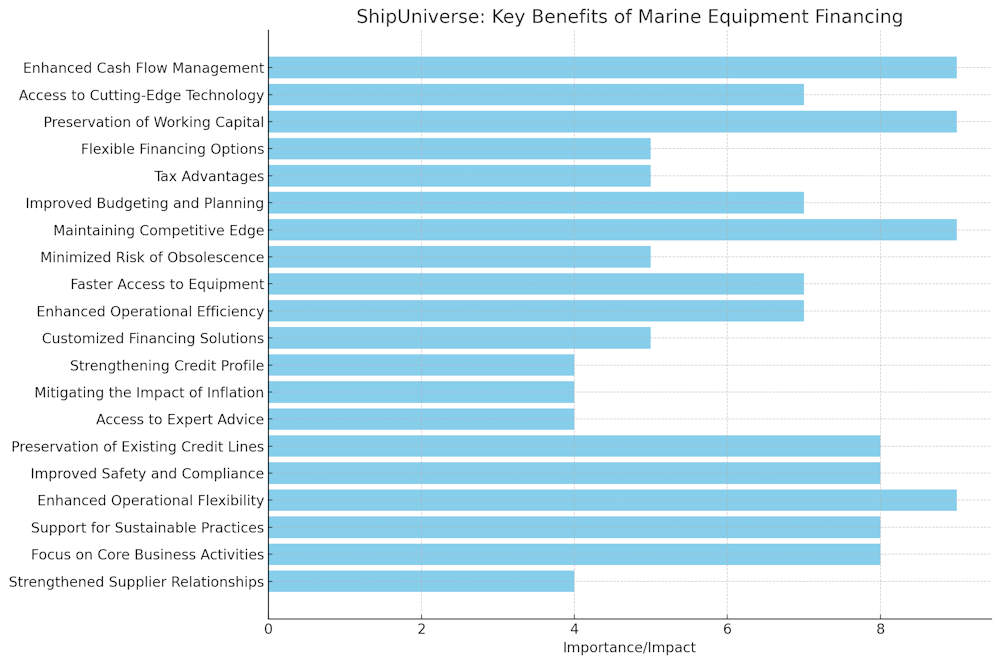

Marine Equipment Financing: Top 20 Benefits

In the ever-evolving maritime industry, staying competitive and efficient requires continuous investment in the latest equipment and technology. However, the significant costs associated with acquiring new marine equipment can pose a challenge for many businesses. Marine equipment financing offers a practical solution, enabling maritime companies to invest in essential tools without the burden of hefty upfront expenses. From managing cash flow to accessing cutting-edge technology, the benefits of financing are numerous and impactful. Here are the top 20 reasons why marine equipment financing is a smart choice for maritime businesses in the commercial sector.

* Please send feedback/suggestions to editor @ shipuniverse.com

1. Enhanced Cash Flow Management

One of the primary benefits of marine equipment financing is the ability to manage cash flow more effectively. Instead of making a significant upfront investment, financing allows maritime businesses to spread the cost of equipment over time. This means that companies can maintain their cash reserves for other essential expenses such as maintenance, crew training, or unexpected repairs. By improving cash flow management, businesses can ensure they have the financial flexibility to respond to market changes and operational needs.

2. Access to Cutting-Edge Technology

The maritime industry is continually evolving, with new technologies and equipment being developed to improve efficiency, safety, and environmental performance. Marine equipment financing makes it possible for companies to stay current with these advancements without the burden of large upfront costs. By financing new equipment, businesses can access the latest innovations, ensuring they remain competitive and compliant with industry standards. This access to modern technology can lead to increased operational efficiency and reduced downtime.

3. Preservation of Working Capital

Working capital is crucial for the day-to-day operations of any business, including those in the maritime sector. By choosing to finance marine equipment, companies can preserve their working capital for other critical uses. This could include investing in marketing efforts, expanding services, or improving infrastructure. Maintaining a healthy level of working capital ensures that businesses have the necessary funds to seize new opportunities and navigate economic uncertainties.

4. Flexible Financing Options

Marine equipment financing offers a range of flexible options tailored to meet the specific needs of maritime businesses. Whether it’s a lease, loan, or another financial product, companies can choose the solution that best fits their financial situation and operational requirements. These flexible options allow businesses to structure their payments in a way that aligns with their cash flow patterns, making it easier to manage financial commitments. Additionally, some financing solutions may offer the possibility to upgrade equipment during the term, ensuring that businesses always have access to the best tools for their operations.

5. Tax Advantages

Marine equipment financing can offer significant tax benefits for maritime businesses. Depending on the financing structure and local tax regulations, payments on financed equipment can often be deducted as a business expense. This can reduce the overall taxable income and lead to substantial tax savings. Additionally, certain types of financing may allow companies to take advantage of depreciation benefits, further enhancing the financial advantages of financing new equipment.

6. Improved Budgeting and Planning

Financing marine equipment provides predictable payment schedules, which can simplify budgeting and financial planning for maritime businesses. Knowing the exact amount and timing of payments allows companies to plan their finances more accurately and avoid unexpected financial strain. This predictability is particularly valuable in the maritime industry, where operational costs can fluctuate due to factors like fuel prices and maintenance needs.

7. Maintaining Competitive Edge

In the competitive maritime industry, staying ahead often requires continuous investment in the latest equipment and technology. Marine equipment financing enables businesses to make these investments without delay, ensuring they remain competitive in the market. By having access to advanced equipment, companies can enhance their service offerings, improve operational efficiency, and meet the evolving demands of their clients. This competitive edge can be crucial for attracting and retaining customers.

8. Minimized Risk of Obsolescence

Technology in the maritime sector is rapidly advancing, and equipment that is state-of-the-art today may become outdated in a few years. Financing marine equipment reduces the risk of obsolescence by allowing businesses to upgrade their equipment more frequently. Leasing options, in particular, can provide the flexibility to replace or upgrade equipment at the end of the lease term, ensuring that companies are always using the most current and efficient tools available. This minimizes the risk of being stuck with obsolete equipment that could hinder operational performance.

9. Faster Access to Equipment

One of the significant advantages of marine equipment financing is the speed at which businesses can acquire new equipment. Traditional purchasing processes can be lengthy, involving extensive capital outlay approvals and budget reallocations. Financing options, on the other hand, often come with streamlined approval processes, allowing maritime companies to get the equipment they need quickly. This rapid access ensures that operations continue smoothly without prolonged delays due to waiting for equipment procurement.

10. Enhanced Operational Efficiency

With the ability to finance high-quality, modern equipment, maritime businesses can significantly enhance their operational efficiency. Newer equipment often comes with improved features and capabilities that can lead to faster, more reliable, and safer operations. This efficiency translates into cost savings, reduced downtime, and the ability to take on more projects or contracts, ultimately boosting the company’s profitability and market presence.

11. Customized Financing Solutions

Marine equipment financing providers understand the unique needs of the maritime industry and offer customized financing solutions to meet those needs. These tailored solutions can include flexible payment terms, deferred payment options, and the ability to finance a wide range of equipment types. Customization ensures that each financing agreement aligns with the specific operational and financial circumstances of the business, providing a more strategic approach to equipment investment.

12. Strengthening Credit Profile

Consistently managing financed equipment payments can help maritime businesses build a strong credit profile. Demonstrating the ability to meet financial commitments on time can improve a company’s credit rating, making it easier to secure future financing for other needs. A strong credit profile is an asset for any business, providing access to better financing terms and lower interest rates, which can be crucial for growth and expansion plans.

13. Mitigating the Impact of Inflation

Financing marine equipment can help businesses mitigate the impact of inflation. By locking in financing terms and payment amounts at the time of the agreement, companies can protect themselves against future price increases. This stability allows businesses to better predict their expenses and avoid the financial strain of rising equipment costs over time, ensuring more accurate long-term financial planning.

14. Access to Expert Advice

Many marine equipment financing providers offer more than just funds; they also provide expert advice and support. These experts understand the maritime industry and can help businesses select the best financing options and equipment for their specific needs. This guidance can be invaluable, ensuring that companies make informed decisions that support their operational goals and financial health.

15. Preservation of Existing Credit Lines

By choosing to finance marine equipment, businesses can preserve their existing credit lines for other purposes. Instead of using up valuable credit lines for equipment purchases, companies can maintain them for operational needs, emergencies, or opportunities that require quick access to capital. This strategic use of credit resources can enhance a business’s overall financial flexibility and stability.

16. Improved Safety and Compliance

Modern marine equipment often comes with enhanced safety features and compliance with the latest regulations. Financing allows businesses to upgrade to equipment that meets the highest safety and regulatory standards without the financial burden of an outright purchase. This ensures that companies operate within legal requirements and provide a safer working environment for their crews, reducing the risk of accidents and associated liabilities.

17. Enhanced Operational Flexibility

Marine equipment financing provides businesses with the operational flexibility to scale up or adjust their operations as needed. Whether it's expanding the fleet, upgrading navigation systems, or investing in more efficient engines, financing allows companies to adapt to market demands and growth opportunities quickly. This flexibility ensures that businesses can respond dynamically to changes in the maritime industry without being constrained by capital limitations.

18. Support for Sustainable Practices

Investing in newer, more efficient marine equipment through financing can help businesses adopt more sustainable practices. Modern equipment is often designed to be more energy-efficient and environmentally friendly, reducing fuel consumption and emissions. By financing such equipment, companies can enhance their sustainability efforts, meet environmental regulations, and appeal to environmentally-conscious clients and stakeholders.

19. Focus on Core Business Activities

By financing equipment rather than purchasing it outright, maritime businesses can free up resources and focus on their core activities. Instead of tying up capital in equipment purchases, companies can invest in areas that directly impact their growth and profitability, such as marketing, business development, and customer service. This strategic allocation of resources can drive overall business success.

20. Strengthened Supplier Relationships

Opting for marine equipment financing can help strengthen relationships with suppliers and financing partners. By engaging in long-term financing agreements, businesses can build trust and establish a positive track record with their suppliers. This can lead to better terms, priority access to new products, and more favorable financing options in the future. Strong supplier relationships are invaluable, providing businesses with reliable support and a competitive edge in the maritime industry.

Marine equipment financing provides a wealth of advantages that can drive growth, enhance operational efficiency, and ensure long-term success for maritime businesses. By leveraging flexible financing options, companies can maintain their competitive edge, improve financial stability, and focus on core business activities without the constraints of large capital outlays. As the maritime industry continues to advance, embracing financing solutions will be key to navigating the challenges and seizing the opportunities ahead. Invest in your company's future by choosing marine equipment financing and unlock the full potential of your maritime operations.

Do you have a Maritime Product or Service that may be of interest to Shipowners? Tell us about it here!

Do you have feedback or insights? Please reach out to editor @ shipuniverse.com