Maritime Subsequent Loans: Easy to Digest Guide

In the maritime industry, financing plays a crucial role in maintaining and expanding fleets. One such financing option is the maritime subsequent loan. This type of loan is essentially a secondary mortgage placed on a vessel that already has an existing primary mortgage. Understanding maritime subsequent loans is vital for shipowners and operators, as it provides a pathway to access additional funds needed for various operational and expansion purposes. This guide aims to break down the complexities of maritime subsequent loans into an easy-to-digest format, highlighting their definition, purposes, and key considerations.

Maritime Subsequent Loan

Basic Principles

- Subordination: The subsequent loan is secondary to the primary mortgage. In case of default, the primary mortgage holder has the first claim on the proceeds from the sale of the vessel.

- Collateral: The vessel itself serves as collateral for both the primary and subsequent loans.

- Higher Risk: Due to its subordinate position, a subsequent loan carries higher risk for the lender, often resulting in less favorable loan terms such as higher interest rates.

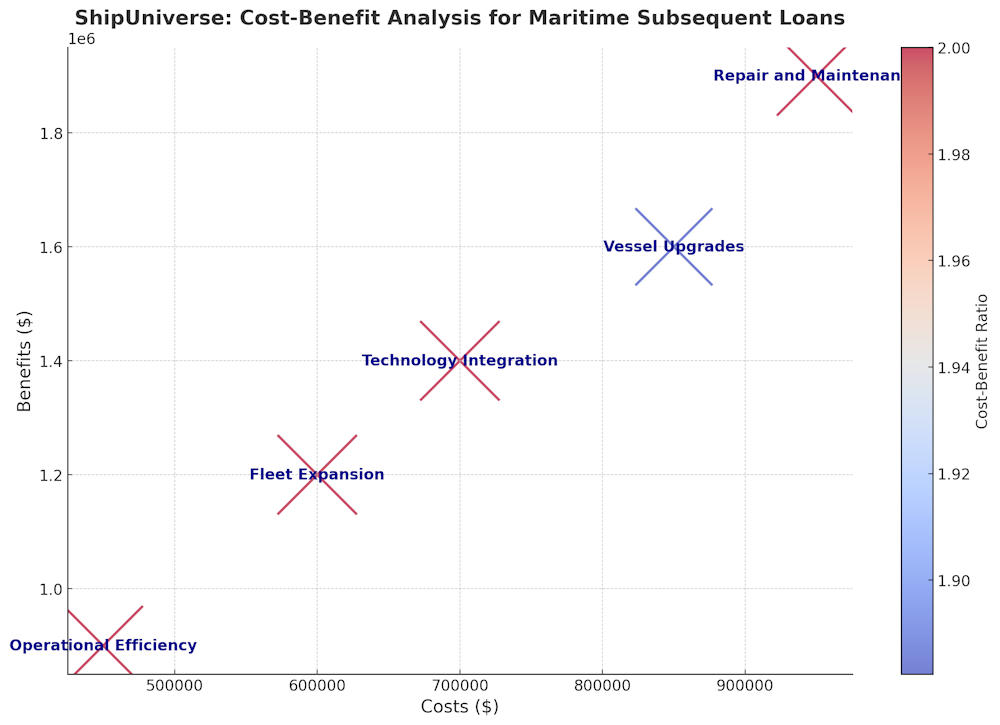

Purpose and Uses of Maritime Subsequent Loans

Common Reasons Shipowners Seek Subsequent Loans

- Vessel Upgrades and Repairs: Shipowners often need substantial funds to upgrade or repair their vessels to meet regulatory standards or improve operational efficiency. A subsequent loan can provide the necessary capital without disturbing the primary mortgage.

- Expansion of Fleet: When expanding their fleet, shipowners might not have enough capital for new acquisitions. A maritime subsequent loan allows them to leverage their existing assets to finance new purchases.

- Operational Expenses: Running a shipping operation incurs various costs, from crew wages to fuel. In times of financial strain, shipowners may turn to subsequent loans to cover these expenses, ensuring smooth and continuous operations.

How Maritime Subsequent Loans Work

The Concept of Primary and Subsequent Mortgages

In the maritime industry, vessels are often financed through mortgages, similar to real estate. The first mortgage placed on a vessel is known as the primary mortgage. When additional funding is required, a second mortgage, or subsequent loan, can be placed on the same vessel. This subsequent mortgage provides the shipowner with extra capital while leveraging the existing asset.

Subordination and Priority of Claims

A key aspect of maritime subsequent loans is subordination. This means that the subsequent mortgage is subordinate to the primary mortgage in terms of priority. If the shipowner defaults on loan payments and the vessel is sold to repay debts, the primary mortgage holder has the first claim on the sale proceeds. Only after the primary mortgage is fully satisfied does the subsequent mortgage holder receive payment. This lower priority increases the risk for the lender of the subsequent loan.

Collateral Involved

The vessel itself serves as collateral for both the primary and subsequent mortgages. The value and condition of the vessel are critical in securing the subsequent loan. Lenders will assess the vessel’s market value, its earning potential, and any existing liens or encumbrances before approving the subsequent mortgage. This collateral arrangement ensures that lenders have a tangible asset to claim in case of default, though the subordinate position affects the security level for the second lender.

Risks and Considerations

Higher Risk for Lenders

Due to the subordinate position of a maritime subsequent loan, lenders face a higher risk. If the shipowner defaults, the primary mortgage holder has the first claim on the vessel’s sale proceeds, leaving the subsequent lender potentially exposed to a shortfall. This increased risk is a significant consideration for lenders when evaluating subsequent loan applications.

Impact on Loan Terms and Conditions

Given the higher risk, subsequent loans often come with less favorable terms compared to primary mortgages. This can include higher interest rates, stricter repayment schedules, and more stringent conditions. Lenders may require additional assurances or guarantees to mitigate their risk exposure.

Factors Affecting the Feasibility of Granting a Subsequent Loan

- Vessel Value: The market value of the vessel is a primary factor. Lenders need to ensure that the combined loan amounts (primary and subsequent) do not exceed the vessel’s value.

- Condition of the Vessel: The physical and operational condition of the vessel impacts its value and earning potential, influencing the lender’s decision.

- Existing Debt: The amount and terms of the primary mortgage and any other existing debts affect the feasibility of granting a subsequent loan.

- Financial Health of the Borrower: The shipowner’s overall financial stability, credit history, and cash flow are crucial in assessing their ability to service additional debt.

- Market Conditions: The state of the maritime industry and market trends can influence a lender’s willingness to provide subsequent loans, as these factors affect the vessel’s earning potential and resale value.

Key Players in Maritime Subsequent Loans

Types of Lenders

Maritime subsequent loans are offered by various financial institutions that understand the complexities of the maritime industry. These lenders provide the necessary capital while mitigating their risks through thorough evaluations and specific loan terms.

Specialized Maritime Lenders

These are financial institutions or funds dedicated exclusively to the maritime industry. They have deep knowledge of maritime operations, vessel valuations, and the unique challenges faced by shipowners. Their expertise allows them to offer tailored financing solutions, including subsequent loans, often with more flexible terms compared to general lenders.

Banks with Maritime Financing Departments

Many large banks have dedicated maritime financing departments. These departments specialize in offering loans and other financial products to the shipping industry. These banks leverage their broad financial expertise to structure loans that meet the specific needs of shipowners.

Private Equity Firms

Private equity firms with a focus on maritime investments also play a role in providing subsequent loans. These firms typically invest in the maritime sector by acquiring stakes in shipping companies or providing specialized financing. They are willing to take on higher risks in exchange for potentially higher returns. Their involvement often includes strategic support beyond mere financing, contributing to the overall growth and stability of the borrowing company.

Legal and Regulatory Aspects

Maritime Laws and Regulations Governing Subsequent Loans

Maritime subsequent loans are governed by a set of maritime laws and regulations that vary by jurisdiction. These laws ensure the proper registration, enforcement, and priority of maritime mortgages. Compliance with these regulations is crucial for both lenders and borrowers to protect their interests and maintain legal standing.

Registration and Enforcement of Maritime Mortgages

Maritime mortgages, including subsequent loans, must be registered with the appropriate maritime authority in the vessel’s country of registry. This registration process ensures that the mortgage is legally recognized and enforceable. In the event of default, the registered mortgage provides the lender with a legal claim against the vessel, allowing them to initiate foreclosure proceedings if necessary. Enforcement of maritime mortgages typically involves court proceedings and adherence to international maritime conventions.

Variations by Country

The legal framework for maritime subsequent loans can vary significantly from one country to another. Each country has its own set of maritime laws, registration procedures, and enforcement mechanisms. For example:

- United States: Maritime mortgages are governed by federal laws and must be recorded with the U.S. Coast Guard’s National Vessel Documentation Center.

- United Kingdom: The Merchant Shipping Act regulates maritime mortgages, and they must be registered with the UK Ship Register.

- Greece: Greek maritime law outlines specific requirements for mortgage registration and enforcement, reflecting the country’s significant shipping industry.

Advantages and Disadvantages

Pros for Shipowners

- Access to Additional Funds: One of the primary benefits of a maritime subsequent loan is the ability to secure additional capital. This can be crucial for shipowners needing funds for upgrades, repairs, or operational expenses without disturbing the primary mortgage.

- Flexibility in Financing: Maritime subsequent loans provide shipowners with flexibility in their financing options. This additional capital can be used for various purposes, allowing shipowners to address immediate financial needs or take advantage of growth opportunities.

Cons for Shipowners

- Higher Interest Rates: Due to the higher risk for lenders, subsequent loans often come with higher interest rates compared to primary mortgages. This can increase the overall cost of borrowing and impact the shipowner’s profitability.

- Increased Financial Risk: Taking on additional debt increases the financial burden on the shipowner. In the event of economic downturns or operational challenges, the added debt from a subsequent loan can strain the shipowner’s financial stability and increase the risk of default.

Steps to Obtain a Maritime Subsequent Loan

Preparing for the Loan Application

- Assess Financial Needs: Determine the specific purpose for the subsequent loan, whether it’s for upgrades, repairs, or operational costs. Clear understanding of the financial requirement helps in presenting a strong case to the lender.

- Evaluate Current Financial Health: Review the existing financial status, including cash flow, existing debts, and overall financial stability. Ensure that the business can handle additional debt.

- Improve Creditworthiness: Take steps to improve credit scores and address any outstanding financial issues. A stronger financial position enhances the chances of loan approval.

Documentation Required

- Financial Statements: Provide detailed financial statements, including balance sheets, income statements, and cash flow statements. These documents offer insight into the financial health of the business.

- Business Plan: Submit a comprehensive business plan outlining the purpose of the loan, expected benefits, and repayment strategy. Include projections and financial forecasts.

- Vessel Information: Provide detailed information about the vessel, including its current value, condition, and any existing liens or encumbrances. This helps the lender assess the collateral.

- Existing Loan Details: Include information about the primary mortgage and any other existing debts. This transparency allows the lender to understand the current financial obligations.

Evaluation Process by Lenders

- Credit Assessment: Lenders will conduct a thorough credit assessment to evaluate the borrower’s creditworthiness and ability to repay the loan. This includes reviewing credit scores, financial history, and existing debt levels.

- Collateral Evaluation: The lender will assess the vessel’s value and condition to ensure it is adequate collateral for the subsequent loan. This may involve a professional appraisal.

- Risk Analysis: Lenders will analyze the overall risk associated with granting the subsequent loan. This includes assessing market conditions, the borrower’s financial health, and the potential return on investment.

- Loan Terms Negotiation: Based on the evaluation, lenders will propose loan terms, including interest rates, repayment schedules, and any conditions. Negotiations may follow to agree on mutually acceptable terms.

Maritime subsequent loans offer a valuable financing option for shipowners needing additional funds for various purposes. Understanding the intricacies of these loans, from their definition and purpose to the steps required for obtaining them, is crucial for making informed financial decisions. While these loans provide access to necessary capital and offer flexibility, they also come with higher interest rates and increased financial risk. By carefully preparing for the loan application and understanding the evaluation process, shipowners can better navigate the complexities of securing a maritime subsequent loan and leverage it effectively to enhance their operations and growth prospects.

Do you have a Maritime Product or Service that may be of interest to Shipowners? Tell us about it here!

Do you have feedback or insights? Please reach out to editor @ shipuniverse.com