The Cost of Cargo Insurance and How to Save

Cargo insurance plays a crucial role in protecting ship and fleet owners from potential financial losses due to damage, theft, or other unforeseen events. In the maritime industry, where the value of goods transported can be substantial, having the right insurance coverage is essential. However, with the rising costs of cargo insurance, it’s vital for ship and fleet owners to understand the factors that influence these costs and explore ways to save without compromising on coverage.

Key Points:

- Protection Against Risks: Cargo insurance safeguards against various risks, including natural disasters, accidents, piracy, and theft.

- Legal and Contractual Requirements: Often, cargo insurance is not just a protective measure but a legal or contractual requirement, particularly in international trade.

- Financial Security: Ensures financial compensation in the event of loss or damage, providing peace of mind and stability for business operations.

Focus on Savings:

- Rising Premiums: The cost of cargo insurance has been increasing due to factors such as geopolitical tensions, stricter regulations, and more frequent extreme weather events.

- Economic Pressures: With the global economy facing uncertainties, managing costs has become more critical for maintaining profitability.

- Competitive Advantage: Efficiently managing insurance costs can provide a competitive edge in pricing and operations.

Understanding Cargo Insurance Costs

Cargo insurance costs are influenced by a variety of factors that ship and fleet owners need to consider when assessing their insurance needs. By understanding these factors, owners can make informed decisions that balance coverage and cost effectively.

| ShipUniverse: Example Cost Breakdown | |||

|---|---|---|---|

| Cargo Type | Average Value per Shipment ($) | Average Insurance Premium (%) | Premium Cost ($) |

| Electronics | 500,000 | 1.2 | 6,000 |

| Hazardous Materials | 1,000,000 | 2.0 | 20,000 |

| Perishable Goods | 200,000 | 1.8 | 3,600 |

| Bulk Commodities | 500,000 | 0.7 | 3,500 |

| General Goods | 300,000 | 1.0 | 3,000 |

Factors Influencing Costs

- Type of Cargo

- High-Risk Goods: Items like electronics, pharmaceuticals, and luxury goods often come with higher premiums due to their high value and susceptibility to theft or damage.

- Hazardous Materials: Chemicals, flammable substances, and other dangerous goods typically incur higher insurance costs because of the increased risk of spills, explosions, or contamination.

- Perishable Items: Goods such as foodstuffs and flowers that require refrigeration can also be costlier to insure due to the risk of spoilage.

- Value of Cargo

- Declared Value: The higher the declared value of the cargo, the higher the insurance premium. It's crucial for owners to accurately declare the value to avoid underinsurance or disputes during claims.

- Replacement Cost vs. Actual Cash Value: Deciding between insuring cargo for its replacement cost (the cost to replace it) versus its actual cash value (the cost minus depreciation) can also affect premiums.

- Route and Destination

- Risky Routes: Shipping through areas known for piracy, political instability, or harsh weather conditions can significantly increase insurance costs.

- Port Security: The security level of the departure and destination ports also plays a role. Ports with stringent security measures may reduce insurance premiums due to lower risk.

- Insurance Coverage Options

- All Risk Coverage: This comprehensive coverage includes most perils except for specific exclusions. It usually comes at a higher cost but offers extensive protection.

- Named Perils Coverage: Covers only specific risks explicitly listed in the policy, often resulting in lower premiums but with more limited coverage.

- Total Loss Only Coverage: This option is typically the least expensive, covering only situations where the cargo is completely lost.

- Deductibles and Exclusions

- Higher Deductibles: Choosing a higher deductible can lower premium costs, but it means the owner will pay more out of pocket in the event of a claim.

- Exclusions: Understanding what is excluded from coverage is crucial. Common exclusions might include war, nuclear events, or inherent vice (damage from the natural qualities of the cargo itself).

Example Figures

To illustrate how these factors influence costs, let's consider two hypothetical scenarios:

- Scenario 1: Electronics Shipment

- Cargo Value: $1,000,000

- Route: Asia to Europe, passing through the Suez Canal

- Coverage: All Risk with a $50,000 deductible

- Estimated Premium: 0.5% of cargo value = $5,000

- Scenario 2: Bulk Grain Shipment

- Cargo Value: $500,000

- Route: South America to North America

- Coverage: Named Perils with a $25,000 deductible

- Estimated Premium: 0.2% of cargo value = $1,000

In these examples, the differences in cargo type, value, route, and coverage result in significantly different insurance costs. Understanding these variables allows ship and fleet owners to tailor their insurance plans to their specific needs and budget constraints.

Strategies to Save on Cargo Insurance

Saving on cargo insurance doesn't mean compromising on protection. By employing strategic measures, ship and fleet owners can reduce their insurance costs while maintaining adequate coverage. Here are some effective strategies:

Optimizing Coverage

- Tailored Policies:

- Customized Coverage: Work with insurers to create a policy that covers only the specific risks relevant to your cargo and shipping routes. Avoid paying for unnecessary coverage.

- Selective Coverage: Opt for Named Perils coverage if your cargo is less susceptible to certain risks, reducing premiums compared to All Risk policies.

- Regular Policy Reviews:

- Annual Assessments: Review and adjust your insurance policies annually to ensure they match your current needs. Changes in cargo types, routes, or values can affect the necessary coverage.

- Claims History Review: Analyze past claims to identify patterns and adjust coverage to mitigate recurring risks, potentially lowering premiums.

Negotiating Terms

- Higher Deductibles:

- Increased Deductibles: Agree to a higher deductible to lower your premium. Ensure you have the financial capacity to cover the deductible in the event of a claim.

- Exclusion Management:

- Understand Exclusions: Clearly understand and negotiate exclusions in your policy. Removing unnecessary exclusions can sometimes lead to cost savings.

Bundling Policies

- Comprehensive Packages:

- Multi-Policy Discounts: Consider bundling cargo insurance with other types of maritime insurance, such as hull and machinery insurance, to receive discounts from insurers.

- Package Deals: Work with insurers who offer comprehensive maritime insurance packages that cover multiple aspects of your operations.

Risk Mitigation

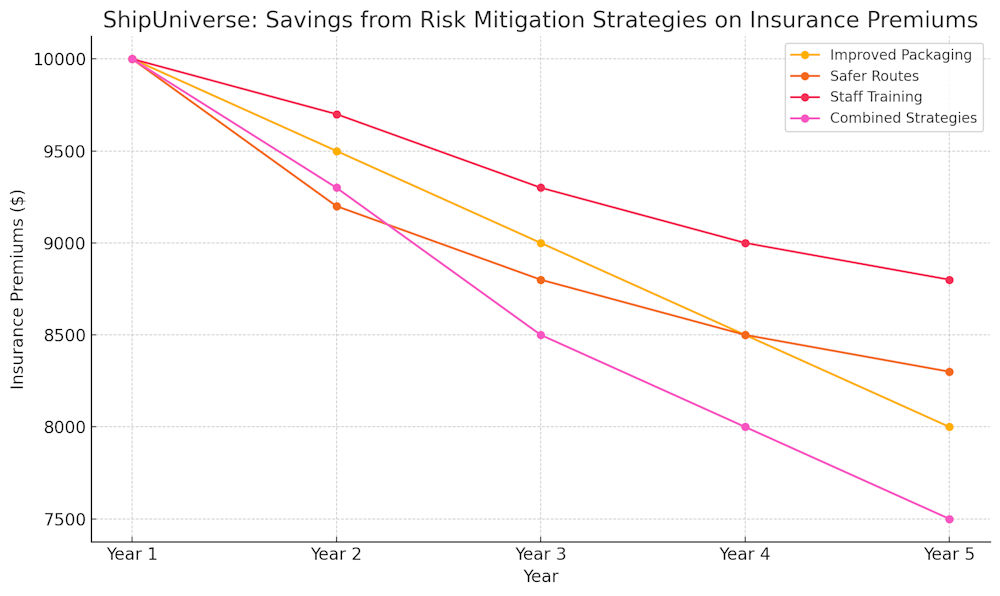

- Improved Packaging and Handling:

- Enhanced Packaging: Invest in high-quality packaging materials and methods to reduce the risk of damage during transit, potentially lowering premiums.

- Training and Protocols: Implement strict handling protocols and training programs for staff to minimize handling-related risks.

- Route Optimization:

- Safer Routes: Choose shipping routes with lower risk profiles, even if they are slightly longer, to reduce the likelihood of incidents that could increase insurance costs.

- Weather Monitoring: Use advanced weather monitoring and route planning tools to avoid hazardous conditions.

Working with Brokers

- Specialized Brokers:

- Expert Advice: Engage specialized maritime insurance brokers who understand the nuances of cargo insurance and can negotiate better terms and rates on your behalf.

- Market Comparison: Brokers can provide comparative quotes from multiple insurers, helping you find the best coverage at the most competitive price.

Example Strategies in Action

- Case Study 1: Electronics Shipment:

- Scenario: A company shipping high-value electronics regularly from Asia to Europe.

- Strategies Applied:

- Customized Coverage: Opted for a tailored All Risk policy covering specific risks associated with electronics.

- Risk Mitigation: Implemented advanced packaging techniques and staff training, resulting in fewer claims and a 10% reduction in premiums.

- Case Study 2: Bulk Grain Shipment:

- Scenario: A grain exporter shipping bulk grain from South America to North America.

- Strategies Applied:

- Bundling Policies: Combined cargo insurance with hull and machinery insurance, securing a 15% discount on the overall premium.

- Route Optimization: Chose a slightly longer but safer route, resulting in a 5% reduction in insurance costs due to the lower risk profile.

These strategies demonstrate practical ways to manage and reduce cargo insurance costs while ensuring comprehensive coverage for various types of shipments.

Regulatory Considerations

Navigating the regulatory landscape is a critical aspect of managing cargo insurance. Compliance with international standards and country-specific regulations not only ensures legal protection but can also impact insurance costs. Understanding these regulations can help ship and fleet owners make informed decisions about their insurance needs.

Compliance with International Standards

- Institute Cargo Clauses (ICC)

- Overview: The ICC, established by the International Chamber of Commerce, provides standardized insurance coverage terms for different levels of risk (A, B, and C).

- Impact on Costs: Understanding the differences between these clauses helps in choosing the right coverage level, balancing cost and risk protection.

- Recommendation: Consult with your insurer or broker to select the appropriate clause based on your cargo and route specifics.

- International Maritime Organization (IMO) Regulations

- SOLAS Convention: The International Convention for the Safety of Life at Sea (SOLAS) mandates specific safety measures, including cargo handling and stowage, which can influence insurance terms and premiums.

- IMDG Code: The International Maritime Dangerous Goods Code regulates the transport of hazardous materials, impacting the cost and availability of insurance for such cargo.

Country-Specific Requirements

- Local Insurance Mandates

- Compulsory Insurance: Some countries require specific insurance coverages for cargo entering their ports. Understanding these requirements can help avoid legal issues and potential fines.

- Example: Countries like China and India may have specific rules for cargo insurance, particularly for high-risk goods.

- Customs Regulations

- Documentation and Declarations: Accurate and timely documentation is essential for compliance with customs regulations, which can affect insurance claims processing.

- Recommendation: Ensure all cargo documentation is in order and complies with the destination country's requirements to avoid delays and potential additional costs.

Best Practices for Regulatory Compliance

- Regular Training and Updates

- Stay Informed: Regularly update yourself and your team on changes in international and local regulations affecting cargo insurance.

- Training Programs: Implement training programs for your staff to ensure compliance with the latest regulatory standards.

- Engage Legal and Insurance Experts

- Consultation: Work with legal experts and specialized insurance brokers who can provide guidance on regulatory requirements and help tailor insurance policies to meet these standards.

- Use of Technology

- Regulatory Compliance Software: Utilize software solutions that help monitor and ensure compliance with international and local regulations, reducing the risk of non-compliance.

Example Scenarios

- Scenario 1: Compliance with ICC Clauses

- Situation: A company transporting high-value electronics across multiple regions.

- Action Taken: The company selected ICC (A) coverage for comprehensive protection and ensured that all documentation matched the requirements of the importing country, minimizing the risk of claim disputes.

- Scenario 2: Adherence to SOLAS Convention

- Situation: A bulk carrier transporting hazardous materials.

- Action Taken: The company adhered to the SOLAS convention by following proper stowage and handling procedures, which reduced the risk profile and subsequently lowered insurance premiums.

Understanding and adhering to these regulatory considerations not only ensures legal compliance but can also lead to more favorable insurance terms and reduced costs.

Navigating the complexities of cargo insurance is a crucial aspect of maritime operations for ship and fleet owners. By understanding the various factors that influence insurance costs—such as the type of cargo, route, and coverage options—owners can make informed decisions to optimize their insurance plans. Implementing cost-saving strategies, such as tailoring coverage, negotiating terms, and adopting risk mitigation practices, can significantly reduce premiums while maintaining comprehensive protection.

Regulatory compliance, both internationally and locally, ensures not only legal adherence but also smoother claims processes and potential cost savings. By staying informed and working with specialized brokers and legal experts, ship and fleet owners can secure the best possible insurance solutions tailored to their unique needs.

In an industry where margins can be tight, every saving counts. Taking a proactive approach to managing cargo insurance costs not only protects assets but also contributes to the overall financial health and competitiveness of maritime businesses. Now is the time to review your insurance policies, explore savings opportunities, and ensure your coverage is as efficient and cost-effective as possible.

Do you have a Maritime Product or Service that may be of interest to Shipowners? Tell us about it here!

Do you have feedback or insights? Please reach out to editor @ shipuniverse.com