The Role of Emerging Markets in Maritime Shipping

The growth of emerging markets presents numerous opportunities and challenges for the maritime shipping industry. Their strategic development influences global trade patterns, necessitates port modernization, and demands efficient cargo handling solutions. We explore how emerging markets are reshaping the maritime industry, highlighting the trends, opportunities, and hurdles in these dynamic regions.

* Please send feedback/suggestions to editor @ shipuniverse.com

Understanding Emerging Markets

Definition and Characteristics

Economic Indicators Emerging markets are typically identified by their robust GDP growth, rapid industrialization, and expanding middle class. These factors contribute to an increase in consumer demand and a surge in manufacturing and infrastructure projects. Such growth not only fuels domestic economies but also makes these markets pivotal players in international trade.

Distinguishing Features Unlike developed markets, emerging markets often have volatile economic conditions, higher rates of inflation, and less mature political landscapes. These elements introduce a level of risk but also present unique opportunities for growth and investment, particularly in sectors like maritime shipping, where infrastructure development is crucial.

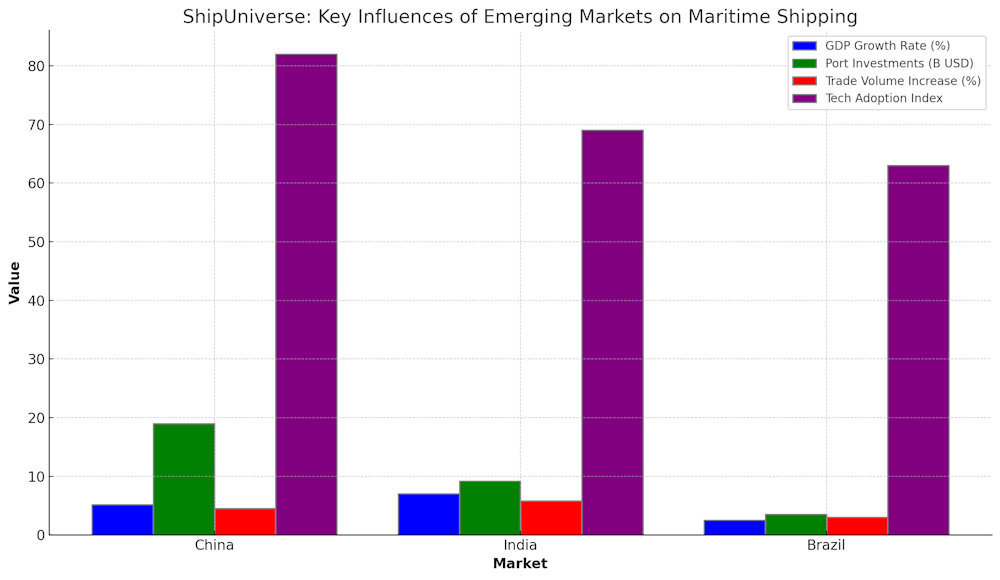

Key Emerging Markets in Maritime Shipping

Asia-Pacific

- China: As the world’s manufacturing powerhouse, China’s impact on maritime shipping is unparalleled. The country’s extensive export activities and massive port infrastructure investments significantly influence global shipping routes and practices.

- India: With a rapidly growing economy and substantial improvements in port infrastructure, India is becoming a key player in maritime shipping, particularly in the Indian Ocean region.

- Indonesia and Vietnam: These countries are emerging as significant maritime centers in Southeast Asia, driven by economic reforms, growing manufacturing sectors, and strategic geographic locations.

Africa

- Nigeria: Nigeria’s vast oil reserves and its efforts to diversify its economy make it a critical maritime hub in West Africa.

- South Africa: As the gateway to Southern Africa, South Africa’s ports handle significant cargo volumes, and it plays a crucial role in regional maritime logistics.

- Egypt: The Suez Canal positions Egypt as a vital link between Europe and Asia, making its maritime activities pivotal to global trade dynamics.

Latin America

- Brazil: Brazil’s size and resource richness drive its maritime activities, with ports playing a vital role in exporting commodities like soybeans and iron ore.

- Mexico: With its proximity to the United States and extensive coastline, Mexico is strategically important for North American maritime trade.

- Chile: Known for its copper exports, Chile’s maritime sector is essential for trade across the Pacific and beyond.

Trends Shaping the Maritime Sector

Shifts in Trade Routes

New Shipping Lanes Emerge As emerging markets grow, they often develop new shipping lanes to accommodate increased trade volume. These routes are not only more efficient but also strategically significant, connecting burgeoning markets with established ones.

Example: The expansion of the Panama Canal has allowed larger vessels to pass through, directly influencing trade flows between Asia and the Americas. Similarly, the Arctic route has seen increased interest due to reduced ice coverage, offering a shorter path between Europe and Asia.

Investment in Maritime Infrastructure

Port Development Emerging markets are heavily investing in their port facilities to handle larger vessels and increased cargo volumes. This development is crucial for accommodating the global demand for shipping services.

Example: Major projects like Sri Lanka’s Hambantota Port and Brazil’s Porto do Açu are transforming these countries into significant maritime hubs.

Technological Advancements The adoption of digital technologies is reshaping how ports operate, from automated container handling to blockchain for logistics. These technologies enhance efficiency and reduce turnaround times.

Example: The Port of Singapore, one of the world’s busiest, has implemented extensive automation and real-time data systems to streamline operations and improve service delivery.

Integration into Global Supply Chains

Emerging Markets as Essential Links As part of their economic development, emerging markets are becoming integral components of global supply chains. Their strategic locations and growing industrial bases make them key nodes in the maritime shipping network.

Data Analysis Statistics on container throughput and cargo volumes in ports like Shanghai, Dubai, and Santos underscore the growing role of emerging markets in global logistics.

Challenges and Solutions While integration provides numerous opportunities, it also presents challenges such as managing increased traffic and ensuring cybersecurity. Solutions include investing in infrastructure upgrades and adopting advanced security protocols.

Opportunities for Maritime Businesses

Market Expansion

Growth Prospects Emerging markets offer expansive opportunities for maritime businesses due to their increasing integration into global trade networks. The surge in trade volumes and the expansion of port capacities create numerous possibilities for service providers, from shipping companies to logistics firms.

Example: Companies that adapt to the infrastructural and regulatory landscapes of markets like Vietnam and Nigeria can tap into rapidly growing import-export sectors, potentially gaining a significant competitive edge.

New Trade Agreements

Impact of Free Trade Agreements New trade agreements can significantly reduce tariffs and streamline customs procedures, making it easier and more profitable for maritime businesses to operate across borders.

Data on Benefits Analysis of recent agreements like the African Continental Free Trade Area (AfCFTA), which aims to create a single market for goods and services across 54 countries, shows potential to boost intra-African trade by reducing trade barriers.

Innovation and Technology Adoption

Technological Advances Innovations in shipping technology, such as automated ships and blockchain-based supply chain management, offer maritime businesses the chance to enhance efficiency and security.

Example: Implementing GPS and IoT technology can help shipping companies track shipments in real-time, reducing the chances of delays and enhancing customer satisfaction.

Environmental Technologies Adopting green technologies not only helps companies comply with international environmental regulations but also appeals to consumers and partners increasingly prioritizing sustainability.

Example: Hybrid and electric propulsion systems in vessels can significantly reduce emissions, aligning with global efforts to combat climate change.

Challenges in Emerging Markets

Regulatory and Operational Hurdles

Complex Regulatory Environments Navigating the regulatory frameworks in emerging markets can be challenging due to inconsistencies and frequent changes. These can affect everything from vessel registration to cargo handling procedures.

Example: In some countries, like Brazil, maritime businesses might face lengthy and unpredictable customs processes that can delay shipments and increase costs.

Operational Challenges Infrastructure deficiencies, such as inadequate port facilities and logistic bottlenecks, often pose significant obstacles in emerging markets.

Example: Port congestion in Nigeria’s Lagos Port can lead to significant delays, impacting the efficiency of shipping operations.

Economic Volatility

Market Risks Emerging markets are often subject to economic fluctuations which can impact maritime operations. Currency instability, inflation, and political instability can quickly alter market conditions.

Data on Volatility Impacts For instance, sudden changes in oil prices can drastically affect shipping costs and profitability. The Russian Ruble fluctuation in 2014 is a case in point, where sudden devaluation affected the costs of operations for many maritime companies.

Environmental and Social Issues

Sustainability Challenges Environmental regulations are becoming stricter, and companies operating in emerging markets must adapt to these changes without compromising their operational efficiency.

Example: The implementation of the International Maritime Organization’s (IMO) low sulfur fuel mandate presents a significant technical and financial challenge for ship operators worldwide.

Social Considerations Maritime businesses must also consider the social impact of their operations, such as community displacement due to port expansions or labor disputes involving ship crews.

Example: Expansion projects like the one at the Port of Mombasa have faced criticism and protests from local communities concerned about displacement and environmental damage.

Case Studies

China’s Maritime Expansion

Belt and Road Initiative China’s Belt and Road Initiative (BRI) is a global development strategy involving infrastructure development and investments in nearly 70 countries and international organizations. It has major implications for maritime trade, particularly in establishing new maritime routes that enhance connectivity between Asia and Europe.

Impact on Trade The initiative has led to significant increases in trade volumes and has necessitated the expansion and modernization of ports along its route. For instance, the development of the Piraeus Port in Greece has transformed it into one of the fastest-growing ports in the world, largely due to Chinese investments.

Nigeria’s Port Development

Lagos Free Trade Zone The Lagos Free Trade Zone, centered around the Lekki Port, represents a major development aimed at enhancing Nigeria’s position as a maritime hub in West Africa. This project includes plans for massive port infrastructure, industrial estates, and logistic hubs.

Economic Impact The development of Lekki Port is expected to significantly alleviate congestion at Lagos’s main ports and boost economic activities by providing a more efficient gateway for imports and exports. It aims to create thousands of jobs and enhance Nigeria’s trade capacities.

India’s Maritime Strategy

Sagarmala Project The Sagarmala Project is an ambitious national initiative aimed at enhancing the performance of India’s logistics sector by leveraging its coastlines and waterways. The project includes modernizing existing ports, developing new ports, and improving port connectivity.

Trade Growth The project is projected to reduce the logistics cost for both domestic and EXIM (Export-Import) cargo with optimized infrastructure investment. A key outcome has been the enhancement of port connectivity and the reduction in turnaround times, significantly impacting India’s trade competitiveness.

As we reflect on the burgeoning influence of emerging markets in the maritime industry, it’s evident that their role is not only transformative but also pivotal to the future of global trade. The dynamic interplay of technological advancements, infrastructural developments, and strategic economic policies in these regions continues to redefine traditional shipping routes and practices. For maritime businesses and stakeholders looking to navigate this evolving landscape, staying informed through reliable sources, adapting to regulatory and environmental changes, and embracing innovation are key to leveraging opportunities and overcoming challenges. By proactively engaging with these markets, companies can ensure their place at the forefront of a more connected and efficient global maritime network, poised for future growth and success.

Additional References

Organizational Reports

- Bureau of Transportation Statistics (BTS): Provides data on U.S. and international transportation, including maritime commerce statistics which can be useful for understanding trends and volumes in emerging markets.

- Website: BTS Maritime Program

- International Chamber of Shipping (ICS): Offers extensive resources on the standards and regulations affecting international shipping, which can help understand the regulatory environments in emerging markets.

- Website: International Chamber of Shipping

- United Nations Conference on Trade and Development (UNCTAD): Publishes the Review of Maritime Transport that annually assesses global seaborne trade, maritime connectivity, and port activities, including those in emerging markets.

- Website: UNCTAD Review of Maritime Transport

Governmental Resources

- Maritime Administration (MARAD) of the United States: Provides statistics, reports, and studies on maritime trade and industry, including insights into how emerging markets interact with U.S. ports and shipping businesses.

- Website: MARAD Research and Reports

- Ministry of Shipping, Government of India: Shares information and updates on projects like the Sagarmala Project, policies, and initiatives designed to boost India’s maritime sector.

- Website: Ministry of Shipping – India

- China’s Ministry of Transport: Offers updates and data on China’s maritime initiatives, including the Belt and Road Initiative, and provides regulatory updates impacting maritime operations.

- Website: China Ministry of Transport

International Organizations

- International Maritime Organization (IMO): The UN agency responsible for the safety and security of shipping and the prevention of marine and atmospheric pollution by ships. The IMO website is a treasure trove of regulatory updates, safety guidelines, and environmental protocols relevant to global shipping activities.

- Website: International Maritime Organization

- World Bank: Provides access to a wide range of economic data, including reports on trade and infrastructure developments in emerging markets. The World Bank also conducts sector-specific studies that can provide insights into maritime infrastructure investment and economic impacts.

- Website: World Bank – Transport

Do you have a Maritime Product or Service that may be of interest to Shipowners? Tell us about it here!

Do you have feedback or insights? Please reach out to editor @ shipuniverse.com